Tax contribution in 2016

During fiscal year 2016, Inditex’s activity in the 93 markets in which it operates entailed a disbursement of 5.647 billion euros in taxes, of which 2.515 billion were direct taxes. Included in this concept are taxes on benefits, contributions to social security systems, taxes on products and services or environmental taxes, paid in countries where the Group is active.

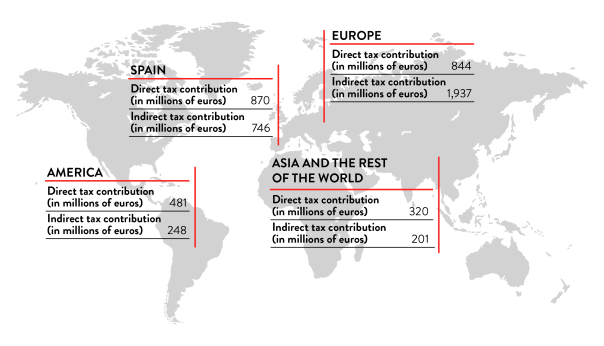

By geographical area, in Spain –where the headquarters of all its brands are located and 16.9% of the Group's total sales are made– Inditex paid 870 million euros in direct taxes; that is, 35% of its global tax contribution. It paid 22% in the European Union and 11% in European non-EU countries. America received 19% of the direct taxes that the Group paid in 2016 and Asia and the rest of the world, 13%.

Looking at corporate tax, the average global tax rate was 22.5%, while in Spain it rose to 24.7% after the payment of 395 million euros during the year; this represents over 2% of the total collection in Spain by corporate taxes.

Moreover, Inditex contributes important returns derived from its activity through taxes generated in all markets where it operates, such as VAT or Income Tax. In 2016, this amount amounted to 3.132 billion euros. In terms of the geographical distribution of this indirect tax contribution, 746 million euros were collected in Spain (24% of the total), and 1.713 billion euros were collected in the remaining EU countries. A further 224 million euros were collected in countries in non-EU Europe (7%), and 248 million euros in America, 8% of the total. In Asia and the rest of the world, this amount was 201 million euros (6% of the total).

This contribution is the materialization of the guiding principles of the Inditex Group's Fiscal Strategy, approved by the Board of Directors in 2015. In this regard, we maintain a commitment of maximum fiscal responsibility in all markets in which we operate, according to a transparent model based on ethical fiscal practices.

To this end, Inditex maintains relations with the different tax authorities of the countries where it operates based on principles of good faith, collaboration and mutual trust. The Group seeks to avoid tax disputes by preferentially applying interpretative criteria on the tax regulations established by said authorities.

Inditex also rejects the use of opaque corporate structures and tax havens. In this way, the Group operates through companies located in those territories only to the extent that it is strictly necessary to carry out commercial activities in them.

In this respect, the Group’s vertically integrated business model means that Inditex is involved in all stages of the value chain of the textile industry (design, manufacturing, distribution and sales). This leads to the performance of operations in different countries pursuant to prevailing legislation in each territory, in accordance with the OECD transfer pricing guidelines, and subject to regular inspection by the tax authorities.

Tax contribution

| Total tax contribution (in billions of euros) | 5.647 |

| Direct taxes | 2.515 |

| Taxes collected for the State | 3.132 |

Direct and indirect taxes

(in millions of euros)

| Tax contribution | Direct taxes | Indirect taxes |

| Spain | 870 | 746 |

| European Union (not Spain) | 564 | 1,713 |

| Europe (non-EU) | 280 | 224 |

| America | 481 | 248 |

| Asia and the rest of the world | 320 | 201 |

| Total | 2,515 | 3,132 |

DIRECT AND INDIRECT CONTRIBUTION taxes by geographical area (in millions of euros)