Tax contribution 2014

Inditex’s activity in the different markets in which it is present resulted in an outlay of 2,066 million euros in direct taxes. This category includes taxes on profits, contributions to social security systems (535 million euros) and taxes on products and services, as well as environmental taxes. In corporate tax, the average rate was 22.6%.

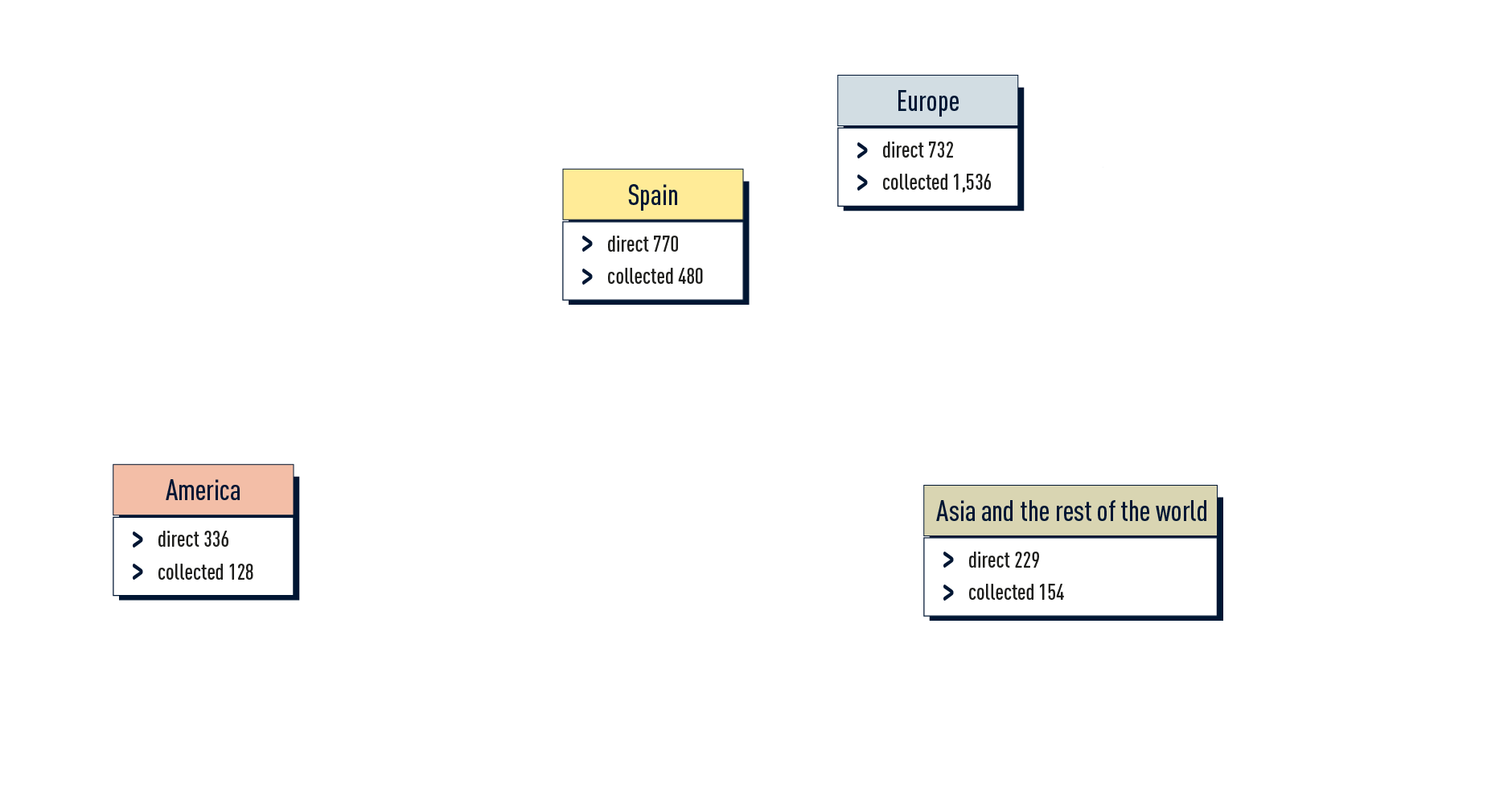

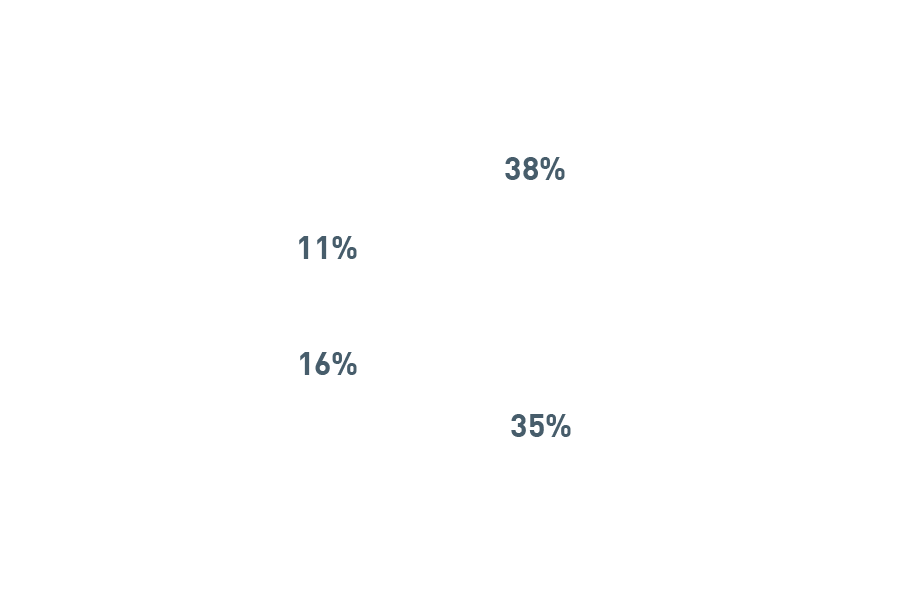

By geographical area, Inditex paid 38% of its direct tax contribution in Spain (770 million euros), 22% in the European Union and 13% in non-EU European countries. America received 16% of the direct taxes that the Group paid in 2014 and Asia and the rest of the world, 10%.

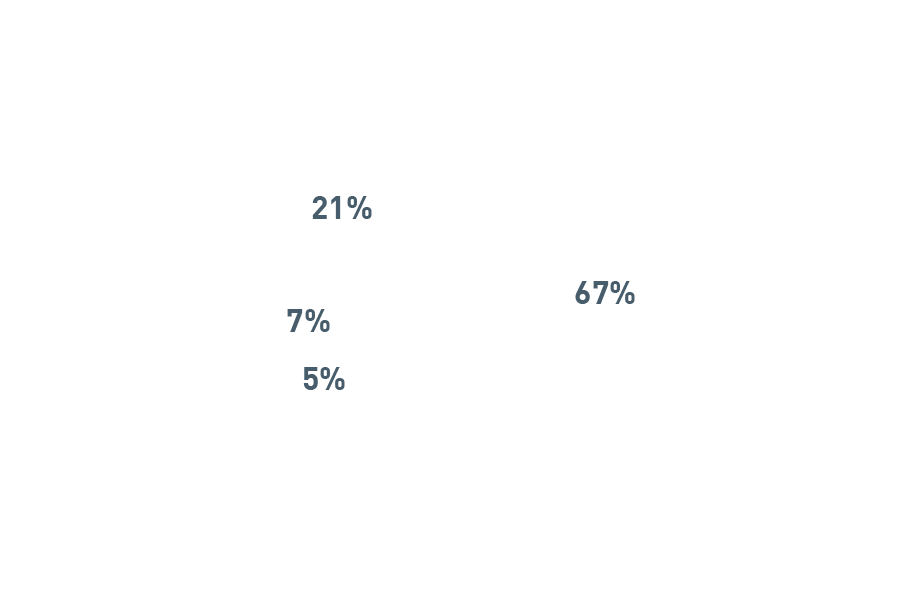

In addition to the taxes that Inditex pays directly to the public tax offices of all of the markets in which it operates,its activity yields important returns which the Group collects for the States. In 2014, this amounted to 2,298 million euros. This includes taxes such as VAT and income tax. In terms of the geographical distribution of this indirect tax contribution, 1,536 million are collected in Europe, of which 1,350 came from EU countries. Another 186 million were collected by the Group for non-EU countries. This does not include Spain, amounting to 480 million (21% of total)million euros (5% of the total).

Tax contribution

| TOTAL (in millions of euros) | 4,364 |

|---|---|

| Direct taxes | 2,066 |

| Taxes collected by States | 2,298 |

Direct taxes (in millions of euros)

| Spain | 770 |

| European Union (not Spain) | 453 |

| Europe (non-EU) | 278 |

| America | 336 |

| Asia and the rest of the world | 229 |

| Total | 2,066 |