Tax contribution 2013

During 2013 financial year, Inditex made a total tax contribution in the markets where it develops its activity of 2.165 billion euros in direct taxes. This category includes taxes on profits, contributions to social security systems (490 million euros) and taxes on products and services (including tariff payment), as well as environmental, among others. The effective tax rate of Inditex in fiscal year 2013 was 22%.

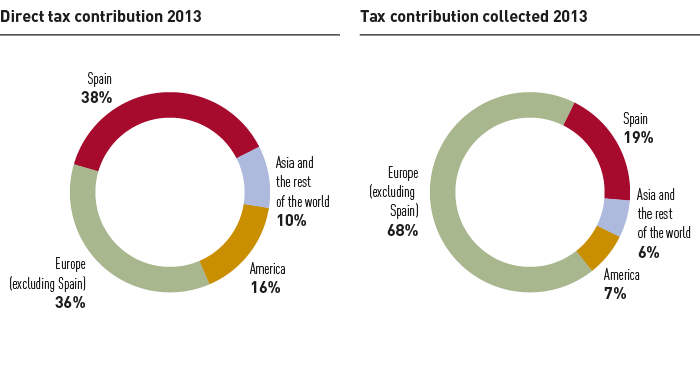

By geographical area, Inditex paid 38% of its direct tax contribution in Spain (821 million euros), 23% in the European Union and 13% in non-EU European countries. America received 16% of the direct taxes that the Group paid in 2013 and Asia and the rest of the world, 10%.

It is worth mentioning that the greater tax base generated in Spain comes from the relevant added value activity that Inditex generates due to the fact that it exports all of its fashion goods from this country. Exports by Inditex from Spain accounted for 31% of total exports in the Spanish textile segment for customs purposes (section 11 of the TARIC Customs Code: textile materials and articles manufactured from textiles) in 2013.

In addition to the taxes that Inditex pays directly to the public tax offices of all of the markets in which it operates, its activity in the regions also yields important returns which the Group collects for the States. In 2013, this amounted to 2.139 billion euros. This includes taxes such as VAT and payment of withholding arising from the salaries paid to employees. In terms of the geographical distribution of this indirect tax contribution, 1.260 billion euros were collected in the European Union. This does not include Spain, where indirect taxes amounted to 405 million euros (19% of total). A further 196 million euros were collected by the company for the state in non-EU Europe. Inditex collected a total of 156 million euros (7% of total) on behalf of the tax authorities in the different American markets where it is present. In Asia and the rest of the world, this figure reached 122 million euros (6% of the total).

| (in billions of euros) | |

| TOTAL tax contribution | 4.304 |

| Direct taxes | 2.165bn |

| Taxes collected by States | 2.139bn |

Direct taxes

| (in millions of euros) | |

| Spain | 821 |

| European Union (not Spain) | 497 |

| Europe (non-EU) | 272 |

| America | 357 |

| Asia and the rest of the world | 218 |

| Total | 2.165bn |