Context

Revamped retail space designed with eco-efficiency criteria

The Inditex Group stores, bricks-and-mortar and online, are the main channel of communication used by the company to get to know its customers’ preferences, which lie at the very heart of Inditex’s business model. As a result, the Inditex Group has allocated a large proportion of the 1.24 billion the company invested in 2013 to opening new stores and refurbishing and expanding existing ones. The past year was characterised by a significant effort to improve the commercial network, adapting it to the standards of excellence that guide everything Inditex does. In fact, elements of eco-efficiency were incorporated into all new and refurbished stores in 2013, a practice in line with the Group’s sustainability strategy. Half of Inditex’s 14 stores that have been LEED eco-efficiency certified by the U.S. Green Building Council achieved this recognition in 2013.

Online sales have also been included in this effort and have continued to advance in 2013, breaking into two new markets: Russia and Romania. At year-end the Inditex Group provided e-commerce in 25 markets. Its websites receive about five million visits a day.

Thanks to its constant contact with customer demands, the Inditex Group has launched initiatives such as an item locator service (for both bricks-and-mortar and online stores), improvements in packaging for online orders, and same-day delivery for online purchases.

Integrity of the supply chain

Inditex approved its 2014-2018 supply chain management strategy in 2013. This strategy is based on identifying the activities of suppliers and manufacturers who work for the Group and analysing them in depth in order to help them improve their practices. In 2013 alone, over 4,300 audits were performed and more than 1,100 suppliers (three in four) were trained in matters relating to production traceability.

In the textile sector 2013 was a year marked by the Rana Plaza building tragedy in Dhaka (Bangladesh), which left over a thousand dead, and thousands more injured. Although Inditex had no business relationship with any of the factories in the Rana Plaza, from the outset the company felt it was its duty to participate in the initiatives undertaken to mitigate the effects of the collapse of the building. Inditex was an active collaborator in drafting the Bangladesh Accord on Fire and Building Safety and was among the first companies to sign the agreement. The company was also selected to be a member of the Accord’s implementation team and member of its Steering Committee.

Another commitment Inditex made to its supply chain was to ensure a fair wage for all workers along the supply chain. The Group’s experience has revealed that, on the one hand, the legal minimum wage in certain regions is not always synonymous with a fair wage and that, on the other, the best way to address these issues is through direct negotiation between employers and employees. For this reason and to ensure fair trading conditions Inditex encourages dialogue between the parties under its framework agreement with the global union IndustriALL. In this regard, in 2013 Inditex launched programmes to promote workers’ associations in Portugal, Morocco, China, Argentina and Brazil, in addition to the existing association in Turkey. Furthermore, Inditex has joined the fair wages task force created in 2013 by the Ethical Trading Initiative.

Responsible products

LProduct health and safety is one of the guiding principles of Inditex’s business model, and the company’s strategy in this area is continual innovation. Thus, in 2013 Inditex launched a pioneering programme for good manufacturing practice (Ready to Manufacture) that prevents the use or generation of unwanted substances during manufacturing. As part of its initiative The List, by Inditex, the Group has compiled a ranking of dyes, pigments and auxiliary chemical products according to their suitability for use in the supply chain.

Inditex has further strengthened its commitment to animal welfare. In 2013, the Group pledged to place no new orders of angora wool until the corresponding facilities have been inspected once again and the results have been checked against Inditex auditing protocol.

Reducing chemicals and emissions

Aware that water is a precious, limited resource used in a large proportion of its production process, Inditex created a Global Water Management Strategy to define its commitments in this area. An essential part of this strategy is the progress that the Group made in 2013 to reach “zero discharge” of unwanted chemical substances, a commitment Inditex made in 2012. These developments include the steps Inditex has taken hand-in-hand with its suppliers. For example, the Group published the Manufacturing Restricted Substances List (MRSL), mandatory for workshops and factories that work for the Group. Inditex also published the results of analyses of its major suppliers in order to assess the presence of priority chemicals in their waste. Moreover, Inditex participates together with eight other textile brands in the Bangladesh Water PaCT: Partnership for Cleaner Textile project, which works to increase awareness and training in different factories to reduce water, energy and raw material consumption as well as levels of wastewater and emissions.

Inditex also released its Global Energy Strategy this year which, among other objectives, aims to reduce energy consumption in the value chain in addition to mitigating direct and indirect emissions associated with both the production process and distribution. Examples of the Group’s commitment to energy efficiency are the new Pull&Bear and Inditex offices (located in Narón and Arteixo respectively), and the new logistics centre in Guadalajara, all currently in the process of achieving LEED Gold Certification. The Tempe 3 logistics platform has BREEAM building sustainability certification.

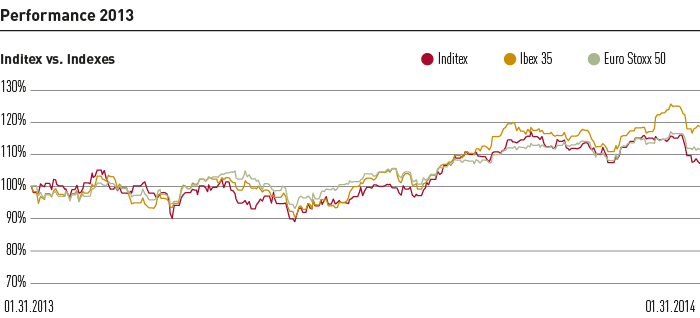

Stock market performance

Shares in Inditex saw growth of 7.3% during the financial year 2013, closing at 110.7 Euros per share on 31st January 2014, compared to the 11.5% increase in the Euro Stoxx 50 and the 18.6% increase in the Spanish IBEX 35 Index over the same period. The average negotiated volume of shares was approximately 1.9 million per day.

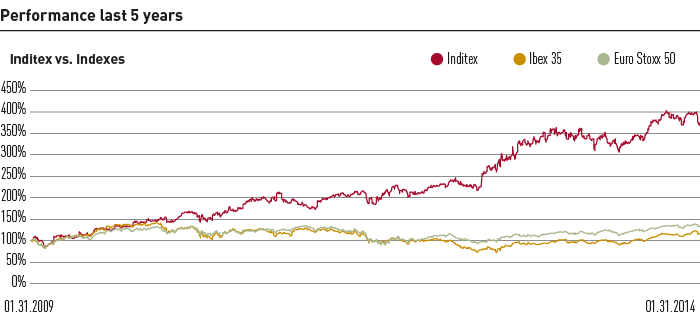

Inditex´s market capitalisation stood at 69,002 million Euros at year end, 653% more than its initial market value on 23rd May 2001, as compared to the 3% increase of the IBEX 35 during the same period.

In May and November 2013, the dividend for fiscal 2012 was paid out, amounting to the sum of 2.20 Euros per share.