Tax contribution 2012

| (millions of euros) |

|

|---|---|

| TOTAL Tax Contribution | 4,099 |

| Borne Tax Contribution | 1,930 |

| Collected Tax Contribution | 2,169 |

Borne Tax Contribution

| (millions of euros) |

|

|---|---|

| Spain | 760 |

| European Union (not including Spain) | 418 |

| Non-EU Europe | 246 |

| America | 328 |

| Asia and the rest of the world | 178 |

| Total | 1.930 |

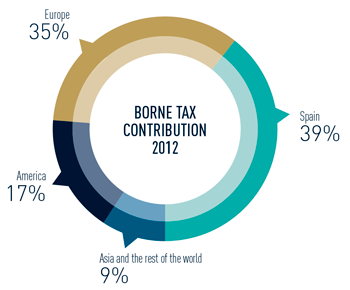

During 2012 financial year, Inditex made a total tax contribution of €1.93 billion in borne taxes in all the markets where it developes its activity. This overall amount includes tax on profits, property and tariffs, among others. Broken down by geographic area, Inditex paid 39% of its tax contribution for the year in Spain (€760 million), 22% in the European Union (418 million) and 13% in non-community European countries (246 million). It also paid 17% of the total tax in the Americas (328 million) and 9% in Asia an the rest of the world (178 million). The average tax rate was 24.4%.

The greater tax base generated in Spain comes from the relevant added value activity that Inditex generates due to the logistic, design and export activities of its goods. This dynamic not only has a positive impact on the balance of trade but also generates the corresponding tax contribution. Exports by Inditex from Spain accounted for 27% of total exports in the Spanish textile segment for customs purposes (section 11 of the TARIC Customs Code: textile materials and articles manufactured from textiles) in 2012.

Collected Tax Contribution

The economic activity generated by Inditex worldwide helps to collect taxes in a very significant amount. Of these, €2.17 billion euros are directly collected by Inditex. This concept includes such relevant aspects as VAT and income tax in each of the countries where the company operates.

Half of this figure (€1.26 billion) corresponds to the European Union, excluding Spain, where 654 million (30% of the total) were raised. In non-community Europe, Inditex raised a total of €171 million for the different states, 8% of the total. Furthermore, in the Americas, the Inditex Group collected €166 million for government treasuries, 8% of the total, while in Asia and the rest of the word this amount was €86 million (4% of the total).